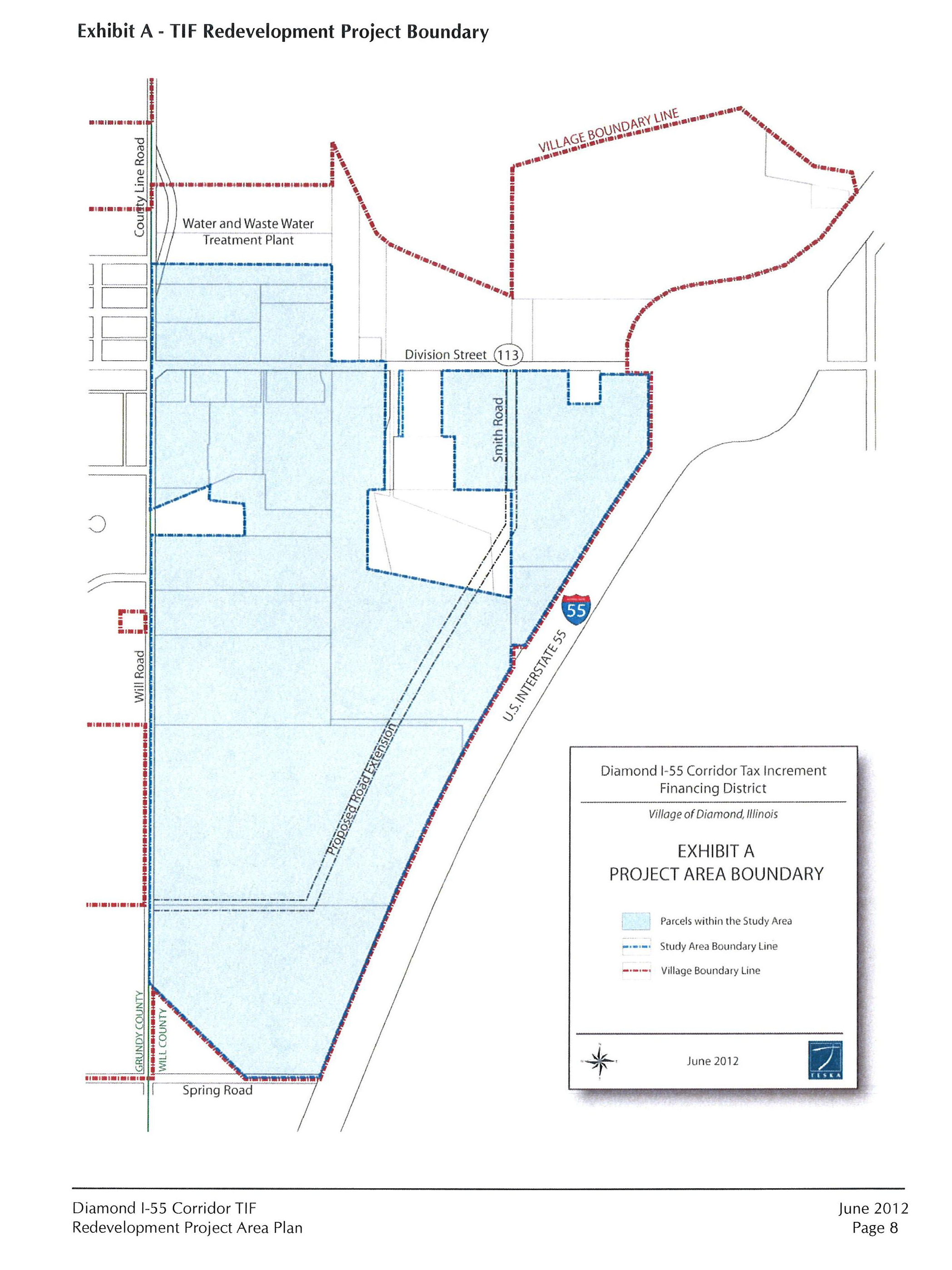

The property is within the I-55 Corridor TIF District approved by the Village in July of 2012. The TIF is in place until 2035 with funds earmarked to assist with development costs to spur the growth of the area into a regional primary commercial corridor.

The property is located in an approved Illinois Enterprise Zone.

Businesses expanding in an Illinois Enterprise Zone may be eligible for the following state and local tax incentives if they meet certain requirements:

State Incentives and Exemptions

- Exemption on retailers’ occupation tax paid on building materials

- Expanded state sales tax exemptions on purchases of personal property used or consumed in the manufacturing process or in the operation of a pollution control facility

- An exemption on the state utility tax for electricity and natural gas

- An exemption on the Illinois Commerce Commission’s administrative charge and telecommunication excise tax

- Enterprise Zone Construction Jobs Credits: Allows eligible project owners to deduct received tax credits from their taxable income

Local Incentives and Exemptions

In addition to state incentives, each zone offers local incentives to enhance business development projects. Each zone has a designated local zone administrator responsible for compliance and is available to answer questions